At the request of the Federal Trade Commission, a federal court has shut down Butterfly Labs, a Missouri-based company that allegedly deceptively marketed specialized computers designed to produce Bitcoins, a payment system sometimes referred to as “virtual currency.”

The FTC’s complaint against the company and its corporate officers alleges that Butterfly Labs charged consumers thousands of dollars for its Bitcoin computers, but then failed to provide the computers until they were practically useless, or in many cases, did not provide the computers at all.

A company representative said that the passage of time rendered some of their machines as effective as a “room heater.” The FTC charged that this cost the consumers potentially large sums of money, on top of the amount they had paid to purchase the computers, due to the nature of how Bitcoins are made available to the public.

“We often see that when a new and little-understood opportunity like Bitcoin presents itself, scammers will find ways to capitalize on the public’s excitement and interest,” said Jessica Rich, director of the FTC’s Bureau of Consumer Protection. “We’re pleased the court granted our request to halt this operation, and we look forward to putting the company’s ill-gotten gains back in the hands of consumers.”

Bitcoins can be used for the exchange of goods and services and can also be traded for physical currency such as dollars or euros. Bitcoins have a significant monetary value that constantly fluctuates. For example, it is currently valued at just under $500 per unit but it was worth more than $1,000 per unit last November.

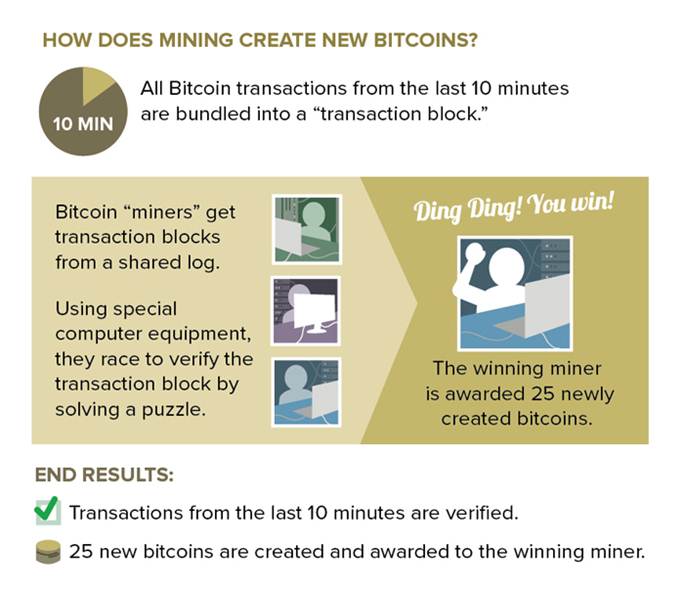

Unlike traditional currency, Bitcoins are not distributed by a central bank, but instead are “mined” by users who use computers to calculate increasingly complex algorithmic formulas. When a user solves a formula, the Bitcoin system awards that user a set number of Bitcoins. As time passes and more Bitcoins are mined, mining becomes more difficult. The codes become more complex and require more powerful computers to solve them.

The FTC’s complaint alleges that Butterfly Labs marketed Bitcoin mining machines. Starting in June 2012, Butterfly Labs touted the computers, which they called BitForce, as cutting-edge, powerful and efficient. Consumers who bought the computers were required to pay in full, up front. The computers ranged in price from $149 to $29,899 based on the computers’ purported computing power. According to the FTC’s complaint, as of September 2013, more than 20,000 consumers had not received the computers they had purchased.

Despite failing to deliver tens of thousands of BitForce computers, the complaint alleges that Butterfly Labs in August 2013 announced a new, more powerful computer to mine Bitcoins called the Monarch, which was available for sale for $2,499 to $4,680. According to the FTC’s complaint, the company had delivered few, if any, Monarch computers as of August 2014.

Even where Butterfly Labs did deliver a Bitcoin mining computer to a consumer, the complaint notes that because of the unique nature of the Bitcoin system, the outdated computers were useless for their intended purpose. While more Bitcoins are being mined each day, the total number of Bitcoins available to mine is reduced in half each year. Combined with the fact that each new generation of computing technology used to mine Bitcoins renders previous generations essentially obsolete, the delay in delivering computers to consumers meant that the Bitcoin mining computers could never generate the amount of Bitcoins that Butterfly Labs promised consumers.

Butterfly Labs, the complaint alleges, also offered a service beginning in December 2013 in which consumers would pay up front for Bitcoin “mining services” in which the company would provide Bitcoins to consumers in exchange for payment for computing time. The complaint notes that by August 2014, Butterfly Labs had not provided any Bitcoin mining services to consumers, despite some having paid thousands of dollars for the services.

The court’s order in the case requires the defendants to immediately stop making misrepresentations about their products and services, and places a freeze on their assets.

The defendants in the case are BF Labs, Inc., doing business as Butterfly Labs; Darla Drake; Nasser Ghoseiri and Sonny Vlesides.

The Commission vote authorizing the staff to file the complaint was 5-0. The complaint and request for a temporary restraining order was filed in the U.S. District Court for the Western District of Missouri. The court granted the order on Sept. 18, 2014.

NOTE: The Commission files a complaint when it has “reason to believe” that the law has been or is being violated and it appears to the Commission that a proceeding is in the public interest. The case will be decided by the court.

FTC staff will answer questions about its Butterfly Labs case on Twitter at 3 p.m. today. Follow @FTC and tweet questions with the hashtag: #AskFTC.

The Federal Trade Commission works for consumers to prevent fraudulent, deceptive, and unfair business practices and to provide information to help spot, stop, and avoid them. To file a complaint in English or Spanish, visit the FTC’s online Complaint Assistant or call 1-877-FTC-HELP (1-877-382-4357). The FTC enters complaints into Consumer Sentinel, a secure, online database available to more than 2,000 civil and criminal law enforcement agencies in the U.S. and abroad. The FTC’s website provides free information on a variety of consumer topics. Like the FTC on Facebook, follow us on Twitter, and subscribe to press releases for the latest FTC news and resources.