Transitions Optical, Inc., the nation’s leading manufacturer of photochromic treatments that darken corrective lenses used in eyeglasses, has agreed to stop using allegedly anticompetitive practices to maintain its monopoly and increase prices, under a settlement with the Federal Trade Commission announced today. Photochromic treatments are applied to eyeglass lenses to protect the eyes from harmful ultraviolet (UV) light. Treated lenses darken when exposed to UV light and fade back to clear when the UV light diminishes.

“Transitions crossed the line between aggressive competition and illegal exclusionary conduct. It used its monopoly power to strong-arm key distributors into exclusive agreements and unfairly box out rivals so they could not use these distributors,” said Richard Feinstein, Director of the FTC’s Bureau of Competition. “Its actions prevented others from competing on the merits, and consumers were forced to pay more for these lenses as a result. Such conduct runs afoul of the antitrust laws and is unacceptable.”

In 2008, photochromic lenses constituted 18-20 percent of all corrective lenses purchased by consumers nationwide, with sales totaling approximately $630 million at the wholesale level. Over the past five years, Transitions had more than an 80 percent share of photochromic lens sales in the United States, and its share exceeded 85 percent in 2008.

The FTC charges that the company illegally maintained its monopoly by engaging in exclusive dealing at nearly every level of the photochromic lens distribution chain. First, Transitions refused to deal with manufacturers of corrective lenses, known as “lens casters,” if they sold a competing photochromic lens. Further down the supply chain, Transitions used exclusive and other agreements with optical retail chains and wholesale optical labs that restricted their ability to sell competing lenses.

According to the FTC’s complaint, Transitions’ exclusionary tactics locked out rivals from approximately 85 percent of the lens caster market, and partially or completely locked out rivals from up to 40 percent or more of the retailer and wholesale lab market.

In settling the agency’s charges, Transitions has agreed to a range of restrictions, including an agreement to stop all exclusive dealing practices that pose a threat to competition. These provisions will end its allegedly anticompetitive conduct and make it easier for competitors to enter the market.

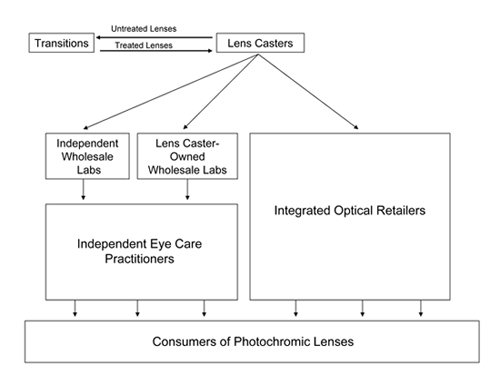

The Photochromic Lens Industry. Transitions partners with lens casters to produce its photochromic lenses. Lens casters provide corrective lenses to Transitions, which then uses proprietary methods to apply patented photochromic materials to the lenses. Transitions then sells the now photochromic lenses back to each original lens caster. These lens casters, in turn, sell and distribute the lenses to consumers through wholesale labs and retailers.

Consumers have a number of options to purchase these lenses. They can buy their lenses from independent ophthalmologists, optometrists, and opticians, who obtain their lenses from wholesale labs. Consumers can also buy their lenses from optical retail chains, as well as smaller retailers, which not only sell lenses but also typically provide their own laboratory services. Both wholesale labs and retailers purchase their photochromic lenses from lens casters.

The FTC’s Complaint. The complaint charges that Transitions engaged in illegal exclusionary conduct to maintain its monopoly in the market for the development, manufacture, and sale of photochromic treatments for corrective lenses in the United States. As evidence of Transitions’ monopoly power, the FTC cites the company’s high market share, the significant barriers that face any new competitor trying to break into the business, and evidence of Transitions’ ability to control prices and to exclude competitors.

The complaint charges that Transitions aimed its exclusionary tactics at lens casters and also at distributors further down the supply chain. With regard to lens casters, the complaint states that one of Transitions’ main competitors, Corning Inc., introduced a new plastic photochromic lens called SunSensors® in 1999. Transitions responded by terminating its supply relationship with the first lens caster to sell SunSensors®, and then announced a general policy to refuse to deal with any lens caster that did not sell Transitions’ lenses exclusively. In 2005, Transitions allegedly made good on this promise when it terminated a second lens caster, Vision-Ease Lens, that had developed a competing photochromic treatment for use on its own lenses called LifeRx®.

According to the FTC’s complaint, Transitions’ “all or nothing” ultimatum coerced lens casters to sell Transitions’s lenses exclusively because losing the sales generated by Transitions’ lenses could jeopardize up to 40 percent or more of a lens caster’s overall profit. The complaint charges that over 85 percent of all photochromic lens sales in the United States are made by lens casters that sell Transitions’ lenses exclusively.

The complaint also charges that Transitions used exclusionary tactics with retailers and wholesale labs further down the supply chain. For example, to fight the competitive threat posed by Vision-Ease Lens’ introduction of LifeRx®, Transitions entered into long-term, exclusive agreements with more than 50 retailers, including most of the large optical retail chains. Transitions also reached agreements with wholesale labs that required the labs to promote Transitions’ lenses as their “preferred” photochromic lens and to withhold normal sales efforts for competing photochromic lenses.

In addition, Transitions’ agreements with retailers and wholesale labs generally required customers to buy all or almost all of their photochromic lens needs from Transitions as part of a bundle. Because no other supplier of photochromic treatments offers a product line as broad as that offered by Transitions, rivals were hindered from competing for these customers, the FTC’s complaint alleges.

The Proposed Settlement. The proposed settlement is designed to end Transitions’ illegal exclusive dealing and to restore competition by making it easier for new competitors to enter the market. Most of the provisions of the proposed settlement will be in effect for 20 years. Most important, the settlement generally prohibits Transitions from putting any agreements or policies in place that limit customers’ ability to buy or sell a competing photochromic treatment, or that require customers to give Transitions’ products more favorable treatment than a competitor’s products.

The proposed settlement order also bars Transitions from limiting the information that its customers give to consumers about competing photochromic treatments. It also prevents Transitions from imposing exclusivity on individual product brands of eyeglass lenses, ensuring that lens casters and others can sell competing photochromic treatments on the same brands of products that they also sell with Transitions’ treatments.

The proposed settlement order also limits Transitions’ ability to offer certain types of discounts. First, it prevents Transitions from offering market share discounts that are based on what percentage of a customer’s photochromic lens sales are Transitions’ lenses. Second, it prohibits Transitions from offering discounts that are applied retroactively once a customer’s sales reach a specific threshold. For example, Transitions cannot provide discounts on the first 999 units that are contingent on the customer purchasing the one-thousandth unit. Third, the settlement order prohibits Transitions from bundling discounts so that customers purchasing more than one line of photochromic lenses obtain additional discounts. These provisions will expire in 10 years.

Finally, the settlement order prohibits Transitions from retaliating against a customer that buys or sells Transitions’ lenses on a non-exclusive basis.

The FTC vote approving the complaint and proposed consent order was 4-0. The order will be published in the Federal Register shortly, and will be subject to public comment for 30 days, until April 5, 2010, after which the Commission will decide whether to make it final. Comments can be submitted electronically at the following link: https://public.commentworks.com/ftc/transitionsoptical.

NOTE: The Commission issues a complaint when it has “reason to believe” that the law has been or is being violated, and it appears to the Commission that a proceeding is in the public interest. The issuance of a complaint is not a finding or ruling that the respondent has violated the law. A consent order is for settlement purposes only and does not constitute an admission of a law violation. When the Commission issues a consent order on a final basis, it carries the force of law with respect to future actions. Each violation of such an order may result in a civil penalty of up to $16,000.

Copies of the complaint, consent order, and an analysis to aid public comment are available from the FTC’s Web site at http://www.ftc.gov and also from the FTC’s Consumer Response Center, Room 130, 600 Pennsylvania Avenue, N.W., Washington, D.C. 20580. The FTC’s Bureau of Competition works with the Bureau of Economics to investigate alleged anticompetitive business practices and, when appropriate, recommends that the Commission take law enforcement action. To inform the Bureau about particular business practices, call 202-326-3300, send an e-mail to [email protected], or write to the Office of Policy and Coordination, Room 383, Bureau of Competition, Federal Trade Commission, 600 Pennsylvania Ave, N.W., Washington, DC 20580. To learn more about the Bureau of Competition, read “Competition Counts” at http://www.ftc.gov/competitioncounts.

(FTC File No. 091-0062)

(Transitions Optical.final.wpd)