Tax-related identity theft was the most common form of identity theft reported to the Federal Trade Commission in 2014, while the number of complaints from consumers about criminals impersonating IRS officials was nearly 24 times more than in 2013, according to FTC statistics released today.

The FTC, along with the Department of Veterans’ Affairs, Treasury Inspector General for Tax Administration, the AARP, and other partners are holding a series of events this week designed to educate consumers about these issues as part of Tax Identity Theft Awareness Week, which begins today and runs through Jan. 30.

“We’ve seen an explosion of complaints about callers who claim to be IRS agents – but are not,” said Jessica Rich, director of the FTC’s Bureau of Consumer Protection. “IRS employees won’t call out of the blue and threaten to have you arrested or demand specific methods of payment.”

“We’ve seen an explosion of complaints about callers who claim to be IRS agents – but are not,” said Jessica Rich, director of the FTC’s Bureau of Consumer Protection. “IRS employees won’t call out of the blue and threaten to have you arrested or demand specific methods of payment.”

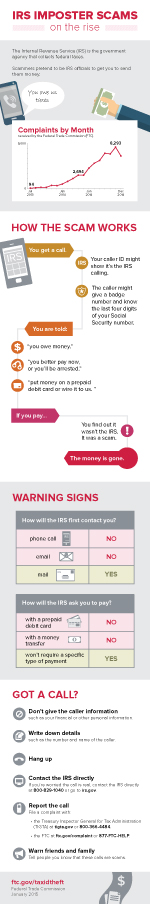

The statistics released today come from the FTC’s Consumer Sentinel database, which accounts for complaints received by the FTC and other federal, state and local law enforcement and consumer protection agencies. In 2013, the FTC received 2,545 complaints about IRS imposter scams; in 2014 that number increased to 54,690. In 2014, the FTC received 109,063 complaints about tax identity theft, accounting for 32.8 percent of the 332,646 overall complaints about identity theft.

Tax identity theft typically happens when a scammer files a fraudulent tax return using a consumer’s Social Security number in order to receive a refund. The year 2014 marks the fifth consecutive year in which tax-related identity theft topped the list of identity theft complaints, with tax identity theft accounting for nearly a third of all identity theft complaints to the FTC.

IRS impersonation scams typically consist of an individual contacting a consumer by phone, claiming that they are an IRS agent and that the consumer owes the IRS money. The callers suggest to consumers that they pay by wiring money or loading money on a pre-paid debit card. The callers often threaten arrest or legal action, and their calls may appear to originate from Washington, D.C. phone numbers; scammers may even know a consumer’s full or partial Social Security number, lending credibility to the scam. The nearly twenty-four-fold increase in complaints related to IRS impersonation indicate that scammers are using this technique against consumers across the country.

Consumers have tools to fight back against these pervasive scams, though. When it comes to tax identity theft, consumers’ best defense is to file their taxes as early as possible to get ahead of scammers who may attempt to use their Social Security number to get a fraudulent refund. If a consumer is a victim of tax identity theft, they should contact the FTC to file a complaint immediately either online or by phone at 1-877-FTC-HELP, as well as contacting the IRS at 1-800-908-4490.

IRS impersonation scams prey on consumers’ lack of knowledge about how the IRS contacts consumers. The IRS will never call a consumer about unpaid taxes or penalties – the agency typically contacts consumers via letter. If consumers get a call purporting to be from the IRS, they should never send money – once it’s sent to the criminal, it is impossible to retrieve. They should instead hang up and report the scam to the FTC and to the Treasury Inspector General for Tax Administration at tigta.gov.

For consumers, the FTC is hosting or co-hosting two webinars and a Twitter chat this week as part of Tax Identity Theft Awareness Week:

- Jan. 27, 2 p.m.: an FTC webinar for consumers, co-hosted with the Treasury Inspector General for Tax Administration and AARP addressing how tax identity theft happens and what consumers should do if they become a victim.

- Jan. 28, 1 p.m.: the FTC and the Veterans Administration will host a webinar with information about tax identity theft for veterans.

- Jan. 29, 3 p.m.: the FTC and the Identity Theft Resource Center will co-host a Twitter chat about tax ID theft – consumers can join the conversation on #IDTheftChat.

In addition to the events, a full array of information for consumers about these issues is available on the Web at www.ftc.gov/taxidtheft. Consumers will find blog posts, publications and information they can use as well as share with friends and colleagues to help spread the word about tax identity theft and IRS impersonation scams.

The Federal Trade Commission works for consumers to prevent fraudulent, deceptive, and unfair business practices and to provide information to help spot, stop, and avoid them. To file a complaint in English or Spanish, visit the FTC’s online Complaint Assistant or call 1-877-FTC-HELP (1-877-382-4357). The FTC enters complaints into Consumer Sentinel, a secure, online database available to more than 2,000 civil and criminal law enforcement agencies in the U.S. and abroad. The FTC’s website provides free information on a variety of consumer topics. Like the FTC on Facebook, follow us on Twitter, and subscribe to press releases for the latest FTC news and resources.