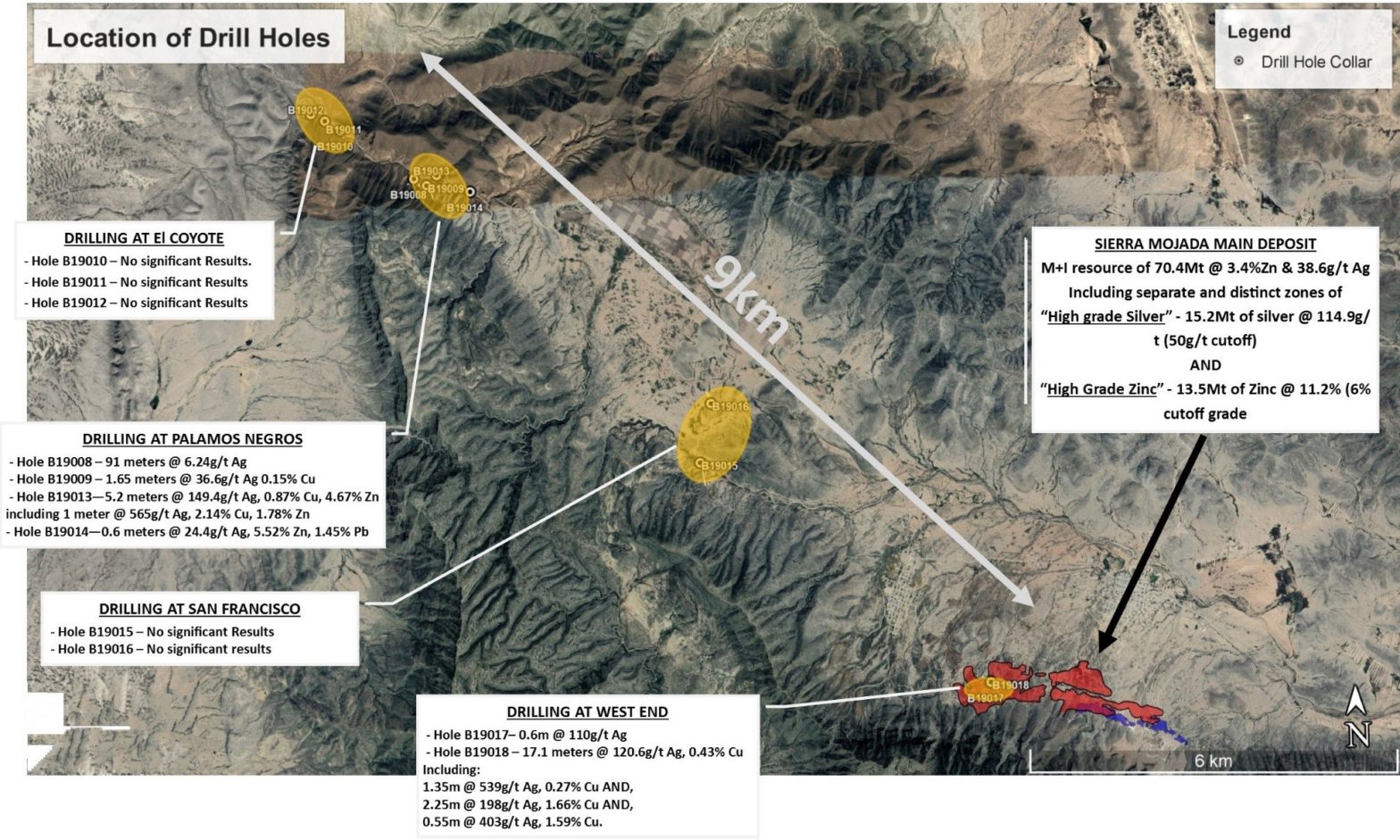

Figure 2

Location of the drill holes drilled under the South32 joint venture option announced in this news release. Also shown is the main deposit at Sierra Mojada.

Silver Bull Resources, Inc.

VANCOUVER, British Columbia, Oct. 04, 2019 (GLOBE NEWSWIRE) — Silver Bull Resources, Inc. (TSX: SVB, OTCQB: SVBL) (“Silver Bull”) is pleased to provide results from an additional 11 drill holes on the Sierra Mojada Project in Coahuila, Northern Mexico.

Highlights from the holes announced in this news release include:

- Hole B19018 – 17.1 meters of oxide mineralization grading 120g/t silver and 0.43% copper including 1.35 meters grading 539g/t silver, 0.27% copper and 2.25 meters grading 198g/t silver, 1.66% copper and 0.55 meters grading 403g/t silver and 1.59% copper from 135.2 meters.

- Hole B19013 – 5.2 meters of sulphide mineralization grading 149g/t silver, 0.87% copper and 4.67% zinc from 137.8 meters.

- Previous results announced from the drill program include:

- Hole B19005 – 13.25 meters of massive sulphide mineralization grading @ 9.05% zinc, 2.12% Lead and 16g/t silver, including 5.85 meters @ 11.93% zinc, 2.83% lead, and 24g/t silver from 75.75 meters.

- Hole B19004 – 0.87 meters of massive sulphide mineralization grading @ 8.14% zinc, 1.83% Lead and 27g/t silver from 46.23 meters.

- Hole B19006 – 0.85 meters of massive sulphide mineralization grading @ 7.25 % zinc, 1.20% Lead, 195g/t silver and 0.13% copper from 129.85m

The Drill Program: Under a joint venture option agreement with South32 Ltd (“South32″), Silver Bull is conducting an initial 8,000 meter regional surface drill program which was subsequently increased to 12,000 meters targeting a series of possible sulphide extensions at depth to the main deposit, as well as a series of never before tested targets within the wider area.

For drilling, the company is using Major Drilling De Mexico S.A de C.V to initially target four historic mining areas within the property, three of which had never been drilled prior to this drill program.

Results:

A summary of the results from the 11 drill holes are shown in the table and map below.

| Hole ID | Area | Hole Length (m) | From | To | Interval (m) | Ag G/T | Zn (%) | Pb (%) | Cu (%) | Comments |

| B19008 | Palomas Negros | 437.5 | 124.35 | 215.35 | 91 | 6.24 | 0.15 | 91 meter wide zone of anomalous mineralization – interpreted as a potental halo around a feeder structure | ||

| B19009 | Palomas Negros | 344.5 | 31.65 | 32.15 | 0.5 | 36.3 | 0.27 | 0.12 | 0.11 | Oxide |

| 33.45 | 35.1 | 1.65 | 36.6 | 0.41 | 0.16 | 0.15 | Oxide | |||

| B19010 | El Coyote | 251.8 | No significant results | |||||||

| B19011 | El Coyote | 318 | No significant results | |||||||

| B19012 | El Coyote | 315 | No significant results | |||||||

| B19013 | Palomas Negros | 413.8 | 137.8 | 143 | 5.2 | 149.4 | 4.67 | 0.87 | Sulphide – including 1m @ 565g/t Ag, 2.14% Cu, 1.78% Zn | |

| B19014 | Palomas Negros | 376.3 | 271.8 | 272.4 | 0.6 | 24.4 | 5.52 | 1.45 | Oxide | |

| B19015 | San Francisco | 743.2 | No significant results | |||||||

| B19016 | San Francisco | 491.6 | No significant results | |||||||

| B19017 | West End | 356.6 | 191 | 191.6 | 0.6 | 110 | Oxide | |||

| B19018 | West End | 407.6 | 135.2 | 152.3 | 17.1 | 120.6 | 0.69 | 0.34 | 0.43 | Oxide – including 1.35m @ 539g/t Ag, 0.27% Cu and 2.25m @ 198g/t Ag, 1.66% Cu and 0.55m @ 403g/t Ag, 1.59% Cu. |

| Table 1. Table summarizing the results of the drill holes announced in this news release. | ||||||||||

Tim Barry, President, CEO and director of Silver Bull states, “The purpose of this last round of drilling was to test a number geological concepts as to the controls on mineralization as well as several regional targets that had never been drilled. Valuable knowledge was gained from this round of drilling with regards to the regional geology. This will be invaluable to targeting additional holes going forward.

Unfortunately due to an illegal blockade by a small cooperative of local miners who hold a royalty on two mineral claims over the eastern end of the main deposit at Sierra Mojada, we have paused the drill program for now. We will look to provide regular updates of the situation as we progress in solving this issue.”

Sample Analysis and QA/QC: All samples have been analyzed at ALS Chemex in North Vancouver, BC, Canada. Samples are first tested with the “ME-MS61m” procedure which analyzes for 49 elements using a 4 acid digestion. Samples with silver values above 100ppm and zinc, lead, and copper values above 10,000ppm (1%) are re-analyzed using the Ag-OG62 procedure.

A rigorous procedure is in place regarding sample collection, chain of custody and data entry. Certified standards and blanks, as well as duplicate samples are routinely inserted into all sample shipments to ensure integrity of the assay process.

South32 Joint Venture Option: In June 2018 Silver Bull signed an agreement with a wholly owned subsidiary of South32 whereby Silver Bull has granted South32 an option to form a 70/30 joint venture with respect to the Sierra Mojada Project. To maintain the option in good standing, South32 must contribute minimum exploration funding of US$10 million (“Initial Funding”) during a 4 year option period with minimum aggregate exploration funding of US$3 million, US$6 million and US$8 million to be made by the end of years 1, 2 and 3 of the option period respectively. South32 may exercise its option to subscribe for 70% of the shares of Minera Metalin S.A. De C.V. (“Metalin”), the wholly owned subsidiary of Silver Bull which holds the claims in respect of the Sierra Mojada Project, by contributing US$100 million to Metalin for Project funding, less the amount of the Initial Funding contributed by South32 during the option period.

About Silver Bull: Silver Bull is a well-financed mineral exploration company whose shares are listed on the Toronto Stock Exchange and trade on the OTCQB in the United States, and is based out of Vancouver, Canada. The Sierra Mojada Project is located 150 kilometers north of the city of Torreon in Coahuila, Mexico, and is highly prospective for silver and zinc.

About the Sierra Mojada deposit: Sierra Mojada is an open pittable oxide deposit with a NI43-101 compliant measured and indicated “global” resource of 70.4 million tonnes grading 3.4% zinc and 38.6g/t silver at a $13.50 NSR cutoff giving 5.35 billion pounds of zinc and 87.4 million ounces of silver. Included within the “global” resource is a measured and indicated “high grade zinc zone” of 13.5 million tonnes with an average grade of 11.2% zinc at a 6% cutoff, giving 3.336 billion pounds of zinc, and a measured and indicated “high grade silver zone” of 15.2 million tonnes with an average grade of 114.9g/t silver at a 50g/t cutoff giving 56.3 million ounces of silver. Mineralization remains open in the east, west, and northerly directions. Approximately 60% of the current 3.2 kilometer mineralized body is at or near surface before dipping at around 6 degrees to the east.

The technical information of this news release has been reviewed and approved by Tim Barry, a Chartered Professional Geologist (CPAusIMM), and a qualified person for the purposes of National Instrument 43-101.

On behalf of the Board of Directors

“Tim Barry”

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800

[email protected]

Cautionary Note to U.S. Investors concerning estimates of Measured, Indicated, and Inferred Resources: This press release uses the terms “measured resources”, “indicated resources”, and “inferred resources” which are defined in, and required to be disclosed by, NI 43-101. We advise U.S. investors that these terms are not recognized by the United States Securities and Exchange Commission (the “SEC”). The estimation of measured, indicated and inferred resources involves greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves. U.S. investors are cautioned not to assume that measured and indicated mineral resources will be converted into reserves. The estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources. U.S. investors are cautioned not to assume that estimates of inferred mineral resources exist, are economically minable, or will be upgraded into measured or indicated mineral resources. Under Canadian securities laws, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies.

Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations, however the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures. Accordingly, the information contained in this press release may not be comparable to similar information made public by U.S. companies that are not subject NI 43-101.

Cautionary note regarding forward looking statements: This news release contains forward-looking statements regarding future events and Silver Bull’s future results that are subject to the safe harbors created under the U.S. Private Securities Litigation Reform Act of 1995, the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and applicable Canadian securities laws. Forward-looking statements include, among others, statements regarding mineral resource estimates, work to understand the controls on mineralization and ability to resolve the blockade. These statements are based on current expectations, estimates, forecasts, and projections about Silver Bull’s exploration projects, the industry in which Silver Bull operates and the beliefs and assumptions of Silver Bull’s management. Words such as “expects,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “continues,” “may,” variations of such words, and similar expressions and references to future periods, are intended to identify such forward-looking statements. Forward-looking statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond our control, including such factors as the results of exploration activities and whether the results continue to support continued exploration activities, unexpected variations in ore grade, types and metallurgy, volatility and level of commodity prices, the availability of sufficient future financing, and other matters discussed under the caption “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended October 31, 2018, as amended, and our other periodic and current reports filed with the SEC and available on www.sec.gov and with the Canadian securities commissions available on www.sedar.com. Readers are cautioned that forward-looking statements are not guarantees of future performance and that actual results or developments may differ materially from those expressed or implied in the forward-looking statements. Any forward-looking statement made by us in this release is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/5f3a0bcf-00e8-41d1-a297-afdafc7841db