Washington, D.C.– As part of the Biden-Harris Administration’s Investing in America agenda, the U.S. Department of the Treasury and the Internal Revenue Service (IRS) today released additional information on a key provision in the Inflation Reduction Act to drive investment in communities that have seen fossil energy industries decline, particularly hard-hit coal communities.

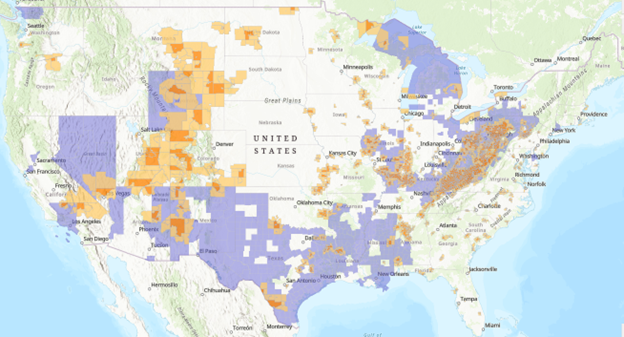

Following initial guidance on the energy community bonus for the clean energy Investment Tax Credit (ITC) and Production Tax Credit (PTC) released in April, Treasury and the IRS provided updates on eligibility for the bonus based on updated local unemployment rate data and technical clarifications. The eligibility updates incorporating 2022 unemployment rates have been included in the map on the Interagency Work Grouping on Coal and Power Plan Communities website at energycommunities.gov.

“The Inflation Reduction Act is designed not just to lower energy costs and combat climate change, but to promote broad-based economic opportunity and create jobs in communities that have been at the forefront of energy production, especially coal communities,” said Deputy Secretary of the Treasury Wally Adeyemo. “Treasury is focused on ensuring all Americans benefit from the growth of the clean energy economy, particularly those who live in communities that have depended on the energy sector for jobs. Economic growth and productivity are higher when all communities can reach their full potential.”

The energy community bonus is available to developers for locating projects in communities historically dependent on fossil energy jobs and tax revenues, including areas with closed coal mines or coal-fired power plants. A census tract where a coal mine closed after 1999, or where a coal-fired electric generating unit was retired after 2009, qualifies as an energy community, as well as directly adjoining census tracts.

The bonus is also available to areas that have significant employment or local tax revenues from fossil fuels and higher than average unemployment. To qualify for the bonus, a metropolitan statistical area or non-metropolitan statistical area must have or have recently had at least 0.17 percent direct employment, or at least 25 percent local tax revenues related to the extraction, processing, transport, or storage of coal, oil, or natural gas, as well as an unemployment rate at or above the national average unemployment rate for the previous year.

Finally, the bonus is available to developers for locating projects on brownfield sites. A brownfield site is defined as real property, the expansion, redevelopment, or reuse of which may be complicated by the presence or potential presence of a hazardous substance, pollutant, or contaminant, and includes certain mine-scarred land.

An image of the updated map follows:

For more information on Treasury’s implementation work around the Inflation Reduction Act, see below.

November 4, 2022: READOUT: Stakeholder Roundtable on Clean Vehicles and the Inflation Reduction Act

November 29, 2022: Treasury Announces Guidance on Inflation Reduction Act’s Strong Labor Protections

December 12, 2022: Treasury and IRS set out procedures for manufacturers, sellers of clean vehicles

December 19, 2022: Treasury, IRS issue guidance on new Sustainable Aviation Fuel Credit

April 4, 2023: Treasury Releases Guidance to Drive Investment to Coal Communities

May 12, 2023: Treasury Department Releases Guidance to Boost American Clean Energy Manufacturing

###